yahoo! finance

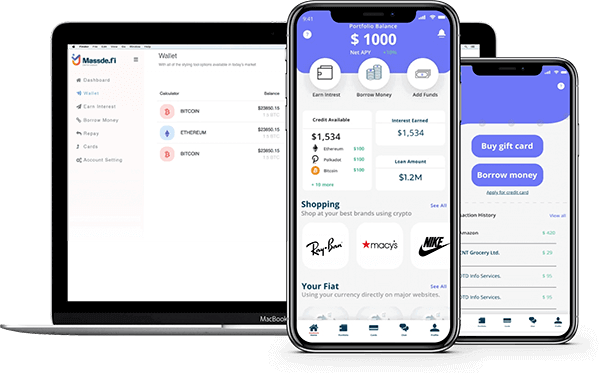

One Click access to all your financial needs

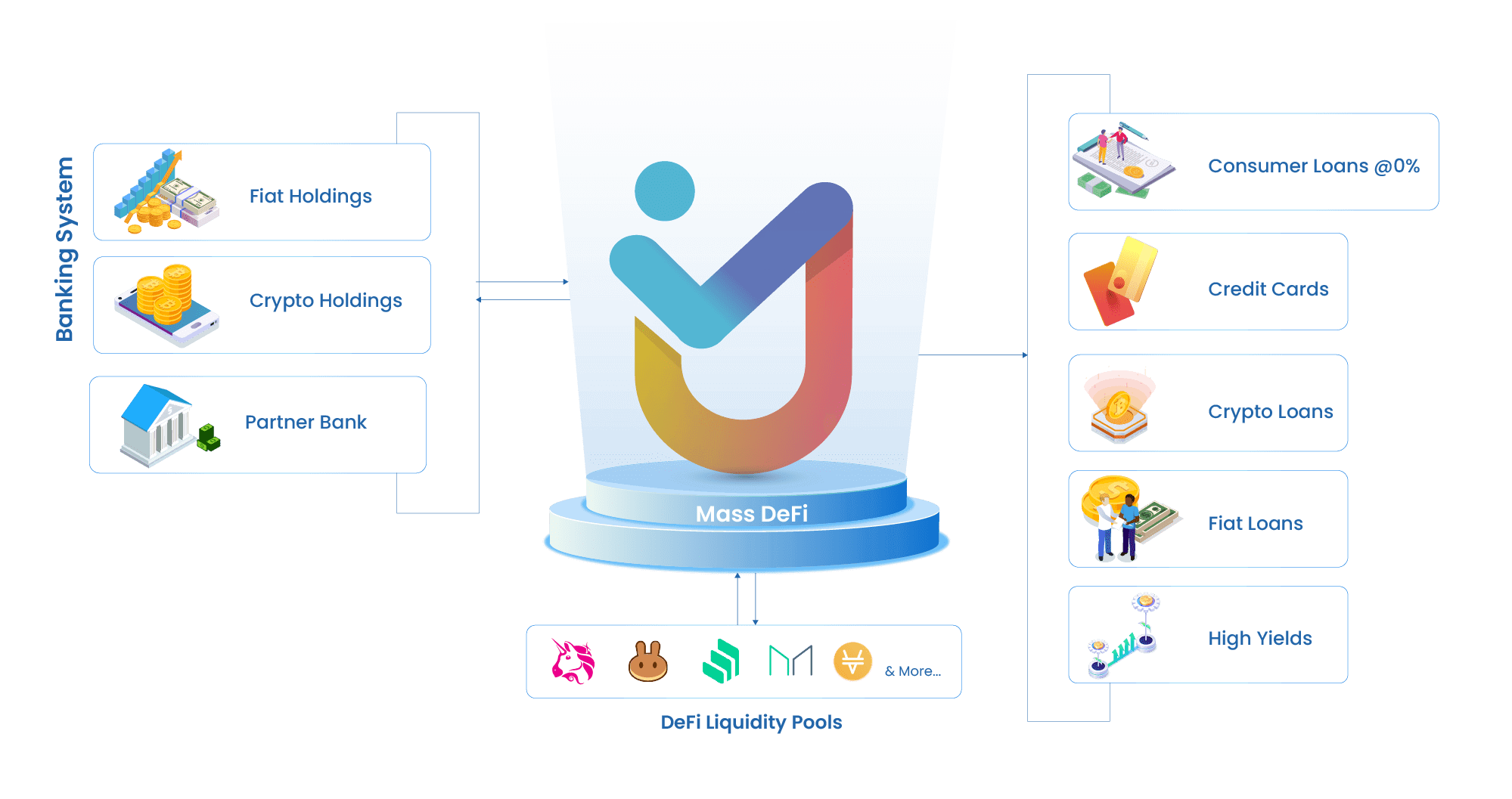

DeFi is short for “decentralized finance.” To eliminate the inefficiencies caused by intermediators like banks and financial institutions, DeFI offers a wide range of financial applications such as lending, borrowing, asset management, derivatives, DEXs on a blockchain network. The Defi platforms are fueled by their native cryptocurrency.